Bear Markets and Inflation

Column 355 June 24, 2022

It’s been a little over a year now since the SGFM columns started including commentary on money and credit, the stock and bond markets, and general business conditions. Each of the columns emphasized the financial risks people are facing by holding onto investments that had been so fruitful during the previous 40 years. There’s no question the columns have been unabashedly bearish on stocks, bonds, precious metals, real estate, and crypto currencies. But, is it time to change?1

During the past several months the stock market became front page news, especially when it was recently declared that the S&P 500 Index had entered bear market territory by falling 20%. Because of the carnage investors had experienced in their portfolios and the dismay shown by most of them, some market pundits are now beginning to turn bullish. They believe a recession is most likely upon us and that will cause the Federal Reserve Bank (Fed) to loosen up by lowering interest rates and we’ll be off the races once again. Unfortunately, I don’t think this downturn will be all that brief and here’s why.

Price inflation is outpacing payroll increases. Shrinking disposable income forces consumers to be more conservative on what they buy. If elevated price inflation rates continue, consumers will continue to cut back and business conditions will deteriorate more than they have so far. In order to slow down inflationary pressures the Fed must take out of circulation some of the excess money that caused today’s price inflation to hit a 40-year high. That calls for higher interest rates and a reduction of the Fed’s holdings of bonds, stocks, and mortgages. (When the Fed sells its assets, the dollars it receives are no longer in circulation and the money supply shrinks.)

Following a near collapse of the world’s credit structure in 2008, the Fed and other central banks around the world turned overly accommodative. In so doing they successfully sidestepped a total meltdown of the credit structure. After pulling off that miracle the central banks of the world (including the Fed) continued with 14 years of aggressive stimulus that saw big increases in the money supply and corresponding big increases in debt outstanding—both of which are now way higher than in 2008.

This is the rub. A dollar is a Federal Reserve Note. When a dollar is created—a liability is created. The created liabilities may be Federal debt, corporate and municipal debt, consumer debt, college debt, or even calls on the Fed’s assets. We all know that more debt is not stronger debt, more debt is weaker debt. Yet while debts have grown significantly since 1981, which is when interest rates peaked, the Fed eventually forced interest rates even lower than market conditions warranted which encouraged more debt.

Then, in 2020 while the Fed was still printing its way out of 2008, along came the pandemic which ushered in a runaway expansion of currency around the world. The result was too much money chasing a limited supply of goods. That’s the classical definition of inflation which causes prices of commodities and goods in the marketplace to rise. Therefore, if prices for goods and services as measured by the Consumer Price Index (CPI) are to stop accelerating at a faster pace and moderate even a little, for a time the central banks of the world need to increase interest rates and stop the growth of debt—which is theoretically what some of them are trying to do now.

Interest rates bottomed nearly two years ago. Since then they have increased in spurts—going up sharply at times to be followed by periods of slightly lower rates similar to pumping the brakes of a speeding car. This pumping action can even cause short-term pauses in the CPI’s rate of gain. But, a brief pause won’t mean the inflation genie has been put back in the bottle. To corral runaway prices, the Fed needs to create slack in overall economic activity while consumptive debts stop growing. That slack will be a recession coupled with a period of debt reduction which usually occurs when short-term interest rates exceed long-term rates. So far interest rates haven’t inverted even though asset prices are already in a bear market.2

When debts are paid off or written off, the money supply shrinks. That’s deflationary if the quantity of money shrinks faster than the quantity of goods and services being offered in the marketplace. That’s what it takes to stop prices from booming as they are today and solve the inflation problem. That’s why the Fed must keep raising interest rates in the months to come and hope that a pause in the growth of debt won’t cause the debt structure to implode.

When a debt structure implodes, it collapses in on itself as one bankruptcy forces the next like a row of falling dominos. That’s what happened month after month from April 1930 through July 1932. During that period the Dow Jones Industrial Average (DJIA) fell from about 297 to 40. That long, drawn-out bear market was far worse than the initial crash that occurred mostly in October of 1929 when the DJIA fell from about 386 to 195 in a few weeks to only rebound quickly over the next several months to 297.

The risks today of a credit implosion are greater than in 1929. That’s because our country has been inflating the currency and compounding its debts nonstop since 1933. The Fed was created in December 1913, so the mistakes it made up until 1929 were mere child’s play compared to what it has done since. That’s why the crunch in 2008 was so scary. It nearly morphed into a debt implosion and the Fed had to use extreme measures to postpone it.

The 2016-2021 period is often referred to as the everything bubble. Signs of excessive speculation just kept getting worse year after year. When 2021 rolled around and the world was awash with pandemic money, nearly all asset prices went completely crazy as they soared to unprecedented heights.

Markets generally cycle from being overpriced to underpriced. That’s one reason why some market analysts expect the consequences of the everything bubble to have repercussions far greater than in any of the bear markets we’ve experienced during the past 90 years. The speculative excesses seen in crypto currencies, stocks and bonds, real estate, and precious metals were unprecedented in many cases and may take years to unwind—not just a few months.

Based on historical valuation measures, today’s asset valuations are still very high and we are not yet officially in a recession. There’s also considerable margin debt behind today’s lofty stock prices and interest rates are still very low. Investors are concerned, but they still have long-term faith in the markets which they won’t have when the actual bottom arrives. Consequently, the downside potential in asset prices (stocks, bonds, real estate, crypto, precious metals, collectibles, and such) remains far greater than the upside potential. Rallies in bear markets always look exciting, but they are traps. This is why exciting bear market rallies must be used to build cash positions for the rainy days ahead—not opportunities to initiate new positions. (Yes, that means holding dollars or going short.)

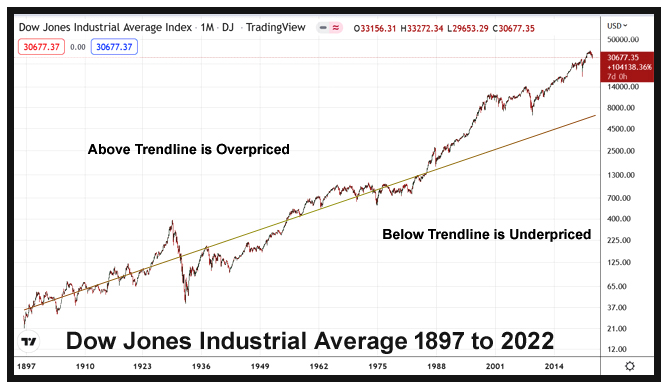

For a pictorial view of the longer term risks, refer to the logarithmic chart in the heading. It goes back to 1897. Note my hand-drawn normalized trendline. Historically, when the DJIA got above that trendline it was overpriced and eventually declined below it. For 88 years the DJIA cycled above and below that value line. Then in November 1985 it rose above the line and never looked back. I believe the DJIA is now more overpriced than it was in 1929. I think that in real terms, not only will the DJIA fall down to the trendline, but it will eventually fall below it.

I have my own personal intermediate-term projections as to what lies ahead. In terms of the DJIA I think it could hit 26,000 by October. Then it may rebound for a couple of months as interest rates drop into the new year. The timing of next big move will depend on the Fed. But in time, I expect assets to fall as interest rates move higher because price inflation won’t be subdued in the next nine months. Therefore, in 2023 the DJIA may take another nosedive down to 14,000 or so and I doubt that the long-term bear market will end there in real terms!

If the CPI remains above 5% in 2023, I think we’ll see the very short-term, three-month Treasury Bill rates, currently about 1.5%, exceed the CPI number. If that happens, most crypto currencies will stop trading entirely as described in my “Modern-Day Pet Rock” column. The recession may turn into a depression. Other events may include a possible expansion of the “diversionary” conflict with Russia, more political strife in our country, food shortages, and more damaging policies coming from our far left, socialist-headed government. For certain the Fed won’t be able to keep interest rates down if the fear factor for defaults increases around the world. If that happens, it’s “Katy bar the door.”3

In closing, I want to make a comment about Biden’s proposal to lower gas prices. If the Federal government decides to go ahead with a gas tax moratorium that is a two-pronged inflationary event. Think about it. The government doesn’t have spare cash lying around. So if it doesn’t collect taxes it must borrow more money which puts more money into circulation to chase a limited supply of goods. Compounding matters is that by lowering the gas price, gas consumption is encouraged rather than discouraged.

The best approach to gas prices is to let the market work it out. As I explained in “Will Inflation Lead to Deflation?” big short-term increases in commodity prices usually lead to significant pullbacks. In April 2020 a barrel of oil was literally worthless. Then it shot up to $126 in March 2022. After a move like that, instead of expecting the oil price to blast higher than the panicky $126 price, it’s likely that in the weeks ahead oil will drift down to trade around $80 a barrel. That may be hailed as a victory over inflation, but it’s no more of a victory over inflation than when lumber dropped from $1,733 in March 2021 to today’s $600. Those price gyrations in individual commodities are just isolated events in the marketplace, they do not represent the values for all goods and services as they’re combined in the CPI.

As a group, our nation’s politicians are as dumb as a sack of hammers. Most of them don’t really understand inflation nor even know the definition of money. Therefore, we can’t look to politicians and bureaucrats to make our lives better. We do that ourselves and just hope we elect representatives who will not make matters worse.

By lowering our exposure to price vulnerable assets, we are setting aside reserves for a rainy day. That strengthens our relative positions with the masses. When the world is entering a recessionary period, for SGFM’s own good it must have financially strong customers. This is why I’m encouraging everyone to recognize the financial risks we face these days. We’re in this boat together and we still do not know just how serious the food shortages may be next year. But you can rest assured that SGFM is preparing the best it can to have more than adequate meat supplies in 2023.

To your health.

Ted Slanker

Ted Slanker has been reporting on the fundamentals of nutritional research in publications, television and radio appearances, and at conferences since 1999. He condenses complex studies into the basics required for health and well-being. His eBook, The Real Diet of Man, is available online.

Don't miss these links for additional reading:

1. What is Money? Column #299 May 28, 2021

Nixon: Incompetent Politician Column #311 August 20, 2021

Universal Basic Income Column #323 November 12, 2021

Actions and Reactions Column #325 November 26, 2021

The Modern-Day Pet Rock Column #326 December 3, 2021

A World Upside-Down Column #333 January 21, 2022

What’s a Murmuration? Column #336 February 11, 2022

Will Inflation Lead to Deflation? Column #345 April 15, 2022

Bullwhip Effect Column #352 June 3, 2022

2. Daily Treasury Par Yield Curve Rates by U.S. Department of the Treasury

3. ‘Next Stage’ of Inflation Is Coming, Economist Says by Petr Svab from The Epoch Times

The Bear Market's Progress to Date