A World Upside-Down

Column #333 January 21, 2022

Our worldview is wildly distorted in more than one arena. That often happens when mobs or depots assume control. Both believe that self determination guided by critical thinking and a belief in God’s word is detrimental to the whole. Today, after suffering through two years of twisted, evil CDC edicts that caused far more harm than good, I think everyone understands how it happens. But the CDC’s medical harms pale in comparison to what our leaders have done to our nation’s money and credit system.

Most people no longer prepare for a rainy day because they believe our money and financial institutions are well protected. Since they’re unprepared, a monetary rainy day for them will be much worse than COVID. That’s because in our modern, highly interdependent world, financial health is required for short-term and long-term survival. It’s very difficult to live off the land in cities and towns. Consequently, since our asset markets are overpriced and the credit structure is a bubble waiting to pop, financial risks have never been greater!

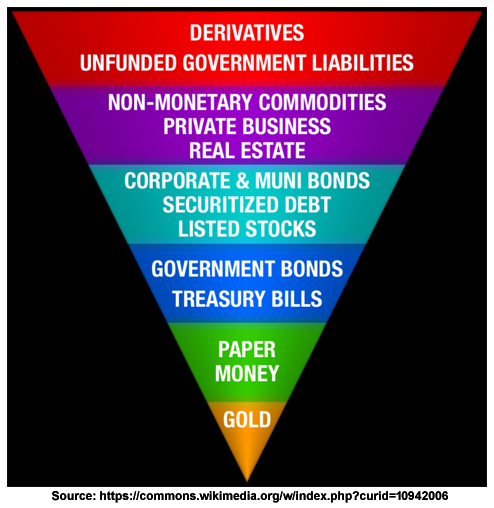

Six weeks ago, in my column on Bitcoin titled “The Modern-Day Pet Rock,” I promised a review of John Exter’s upside down, money and credit pyramid which illustrates how a money and credit system is structured. Amazingly, today’s economists teach and preach the benefits of our credit-based credit system which makes a mockery of the words “money” and “credit” in that they believe they are one and the same! Like the CDC’s COVID czars who don’t see that their masking, distancing, and lockdown policies failed from day one, modern economists don’t understand that perpetual prosperity will not be achieved by managing the constant growth of debt—a policy that has failed from day one and is now about to implode and disintegrate. So, the question is, “Are you ready for the stock market crash and debt structure implosion from hell?”1

The beginning of the end of our country’s sound money system started December 23, 1913, when President Woodrow Wilson created the Federal Reserve System (Fed) by signing into law the Federal Reserve Act. The reason given was that the Fed would alleviate financial crises. That was followed on April 5, 1933, by Franklin D. Roosevelt banning Americans from owning gold. He said that ban was necessary in order to reflate the Fed’s collapsed credit system and reverse deflation. Next, on August 15, 1971, President Richard Nixon slammed shut the “gold window,” eliminating the last vestiges of the world’s money and credit system. He did that to eliminate all restraints on the printing of fiat money (and credit issuance) in order to create perpetual prosperity.2 3 4

Following those three events, economic cycles have only gotten more extreme. Unlike 100 years ago, in today’s America savings are minuscule and most citizens are poorly prepared for hard times. Debts are sky-high and most folks own too many illiquid, unnecessary, lavish, and risky assets. Many people literally live paycheck to paycheck with no personal restraints on frivolous consumption—most of which ends up in the trash. Instead of people becoming independent, the national goal of perpetual prosperity has made everyone financially dependent on the government’s and the Fed’s ability to print money and inflate the debt bubble. It’s all borrow and spend forever.

As for the inflation that FDR wanted, it was so “successful” the purchasing power of today’s fiat dollar has literally evaporated to nearly nothing. Today, one dollar of savings set aside 100 years ago has the purchasing power of one penny. (An ounce of gold was $20.67 in 1913 and is about $1,830 today. Compare that 100-year period to the 1814-to-1914 period when the dollar’s purchasing power was essentially unchanged for 100 years.5

John Exter’s upside down pyramid is very simple. It recognizes that gold has been the world’s money for more than 5,000 years. Gold, an element, is a physical substance. It is acceptable, recognizable, divisible, homogeneous, durable, portable, a store of value, a measure of value, and has great value. It is money. If you have it in your physical possession, you have buying power that cannot go bankrupt.6 7 8

On the other hand, currencies (paper money) are credit instruments. They only have monetary value when they are actually “redeemable on demand” for a certain quantity of gold—or if a seller of goods and/or services is willing to accept them in payment. For instance, in 1930 a $20 bill was redeemable for a $20 gold coin that weighed one ounce. If people lost faith or were concerned about the viability of the institution that issued the $20 bill, they would not accept the currency at face value or, if they had it, they would cash it in. On the other hand, they would never accept the currency at a premium to the value of gold for which it was redeemable. Since a convertible currency is redeemable on demand for specie, and doesn’t have a maturity date like a bond or note, it is a low risk credit instrument that is perched just above gold in Exter’s pyramid.

There are additional forms of credit and also assets in the pyramid. The more distant they are from gold depicts their increasing risk and decreasing liquidity. Just above the currency are government bonds and bills which have a variety of maturity dates. Next in order of risk are corporate bonds, municipal bonds, and stocks. They are followed by nonmonetary commodities, private businesses, and real estate. The highest risk instruments are derivatives and unfunded government liabilities. Again, as one’s holdings move up from the golden base, they are more illiquid and riskier.

That describes the classical money and credit system that generally prevailed for most of recorded history. But it no longer functions in the classical sense, yet people believe that it does.

In the late 1960s I read through the Wall Street Journals from 1929 through 1932. I wanted to know how the news was reported and how the gold stocks performed during that time. The primary gold stocks were Homestake Mining Company (U.S. based) and Dome Mines (Canadian based.) The dollar was redeemable in gold at an exchange rate of $20.67 per ounce.

During WWI the credit structure (the financial debt instruments above gold in Exter’s pyramid) expanded considerably causing prices of labor, goods, services, commodities, stocks, real estate, and collectibles to increase versus the dollar and gold. (Prices rose because more credit caused consumption to grow faster than the production of goods.) After the war, excess debts were not reduced therefore prices remained high. Finally, starting in 1927, prices started to creep down. Then from September 1929 through July 1932 prices for everything collapsed versus the dollar and gold as the credit structure, banking system, and asset values (in the top part of Exter’s pyramid) imploded.9

By mid-1932 the writeoff of bad debts, along with the liquidation of excess credit and speculative debts, was complete and the credit structure started growing again. Gold (the money at the system’s base) and the currencies that remained redeemable for gold stabilized debt and asset prices. The most credit worthy instruments, such as the strongest currencies, held their value only because they continued to be redeemable in gold. They did not survive based on confidence, but because of their actual viability. After the credit system stabilized in 1932, people used their stored gold to acquire currencies in order to purchase goods, services, and assets at reduced prices. That started the rebound—not FDR’s bank closings and kind words.

During the inflationary (expanding credit) years leading up to 1927, gold mining companies had a decade of hard times. Many closed down! That’s because the increasing credit structure drove up mining costs while the dollar continued to be redeemable for an ounce of gold at $20.67. Therefore, gold mining stocks didn't participate in the bull market for stocks that culminated in a wild speculative frenzy in 1929. After the stock market had rocketed to its 1929 peak, it almost immediately crashed. Following the initial big drop in October 1929 that was so famous, there was a partial recovery for a few months. Then stock prices continued to fall again until they bottomed out in July 1932—down 90% from the 1929 peak. As the credit structure contracted between 1928 and 1932, mining costs declined and gold mining companies saw their earnings and dividends increase. Essentially, from 1929 to 1932, while nearly all stocks collapsed with many businesses closing, gold stocks traded sideways or slightly higher which was very noteworthy.10

When the dollar was devalued to $35 an ounce in April 1933, the gold mining companies started making boatloads of money. But as time went by the credit system grew again. Then during WWII debts grew exponentially. That explosion of credit pushed the cost of goods, services, stocks, real estate, and commodities higher and higher. Once again, after the war ended debt was not addressed. Therefore inflation continued into the 1950s and beyond. By the mid-1960s, gold mining almost disappeared as an industry because mining costs had increased significantly while the dollar remained redeemable for gold at $35.

As you can see, when gold is money and the currency/credit system is redeemable in gold, events don’t appear quite like they do today. In yesteryear, when price inflation occurred as currency and credit supplies increased, gold became more scarce and underpriced. As concerns for currency and debt defaults increased, people and nations would redeem questionable currencies for gold which would cause credit systems to shrink. After the credit structures shrunk, confidence would return and people would turn their gold in for currency and the expansion cycle would begin anew. In the stock market, gold stocks went down when others would go up and vice versa.

When the system worked that way, the power of the purse was in the hands of the citizens and not in the hands of politicians and bankers. Naturally, the powers that be could not stand having the people control the finances or the marketplace, which is why owning gold was declared illegal in 1933. The last vestiges of fiscal restraints on our politicians and the Fed ended with Nixon. Now we have an everything bubble on our hands which has grown so top heavy with debt that it has set the stage for a bust the likes of which will make the 1929 to 1932 bust look like a cakewalk.

Today there are no restraints on the quantity of credit or currency that politicians and bankers can issue. Therefore, valuations for everything, including gold, float on a sea of credit. The credit-based credit system is a corrupt, bastardized ponzi scheme of IOU Nothings backed by IOU Nothings. It fits perfectly with today’s woke generation that wants to ignore all restraints on every aspect of life—including one’s own sex. Bitcoin is a financial symbol of the new generation and its backers won’t understand that cryptocurrencies are not money until after the credit structure eventually implodes.

To really illustrate how upside down we are these days, since real money (gold) floats free, like all other commodities and assets, it will also gyrate against the credit structure and other assets even when the credit system implodes. In other words, instead of gold holding firm, in a credit crisis gold can drop to its cost of production which is currently around $500 an ounce. That’s because it is just another asset that people must sell to raise dollars to cover debts when their debts are called.

So here we are with a debt bubble the likes of which the world has never seen before. As John Exter used to say, it exists only because “confidence is suspicion asleep.” And for decades I’ve been saying that, “More debt is not stronger debt. More debt is weaker debt. There’s more debt today than ever before in the history of man.”

The debt bubble is already unsustainable. It’s so big it can burst uncontrollably and the authorities will be powerless to stop it. Right now the only thing that keeps the credit bubble from imploding is confidence in the ability of the Fed and the US Treasury to borrow and spend. The Fed’s chart depicting the growth of the M1 Money Supply literally blows the mind. The slightest pause in the growth of credit like we’ve seen can tip the balance and start a credit implosion. Right now the Fed is playing its fiddle on apposing sides of the financial markets by continuing to print money, slowly raising interest rates, while implying it will stop printing in order to control inflation. That is dangerous because it could set off a sharp drop in the overpriced and overextended stock market just like what happened in 1929. Then, even if it’s not pushed over, because credit and asset values are so overextended, collapsing asset prices could independently cause a debt implosion. So, there’s no telling how it will go.11 12 13

A few days ago, Michael Lebowitz from Real Investment Advice wrote: “The Fed is making it clear they want to reduce inflation. They are also telling us they will ensure financial stability. Sounds like a good plan, but walking the narrow tightrope successfully by achieving lower inflation without destabilizing markets is an incredibly tough task.”14

Currently, 10-year U.S. Treasury Bonds are yielding 1.76% while inflation is roaring at 7%. If interest rates don’t increase who will want to buy U.S. government bonds? That’s why the Fed needs to slow down inflation because 7% interest rates would collapse everything. To slow down inflation the Fed must stop printing money, which shuts off credit expansion. This too can cause a train wreck. So, ladies and gentlemen, this is what is known as being between a rock and hard place.

The Fed is obviously playing with fire by tapping the brakes while speeding on a windy road that’s a sheet of ice. And this brings us to the real kicker. In the initial stages of a credit contraction, all dollar-denominated debts must be paid off in dollars! That means collateralized assets will be sold for dollars. That will most likely start in the highly leveraged stock market where everyone will see asset prices plunge against dollars. Soon after look for drops in the prices of automobiles, boats, airplanes, collectibles, cryptos, real estate, RVs, and commodities. That won’t mean the dollar is fundamentally strong, it will just be a short period of time when dollars will be in demand for the payment of debts. In the end, people will lose confidence in the dollar—especially if the politicians and the Fed try to fix the credit deflation by printing, borrowing, and spending our way out of the hole they dug.

That’s why there will be a time frame out ahead where asset prices will bottom out and gold will be trading near its cost of production. That’s when you stop shorting the market and move dollars into gold and very secure, liquid assets. Those assets must not be currencies or currency-denominated debt instruments. Most likely, when politicians and the Fed leaders come face to face with the results of the erroneous policies that have been in place since 1913, they will double down and cause a hyperinflationary conflagration. And then, at some point, in order to restore confidence the powers that be will create a new dollar and make it redeemable into gold—returning the entire world to John Exter’s upside down money and credit pyramid.

Yes, there will be more to the story. For now, get liquid.

To your health.

Ted Slanker

Ted Slanker has been reporting on the fundamentals of nutritional research in publications, television and radio appearances, and at conferences since 1999. He condenses complex studies into the basics required for health and well-being. His eBook, The Real Diet of Man, is available online.

Don’t miss these links for additional reading:

1. The Modern-Day Pet Rock by Ted Slanker

2. Federal Reserve from Wikipedia

3. FDR Takes United States off Gold Standard from History

4. Today in History: Nixon Slams Shut the “Gold Window” by Michael Maharrey from The Libertarian Institute

5. Historical Inflation Rates: 1914-2021

6. Financial Crisis Protection John Exter Pyramid by James Anderson from SD Bullion

7. John Exter from Wikipedia

9. Wall Street Crash of 1929 from Wikipedia

10. Gold Stocks in a Depression by Jeff Clark

11. USA Debt Clock

12. M1 as Measured by the Federal Reserve Bank of St. Louis

13. M2 as Measured by the Federal Reserve Bank of St. Louis

14. Instability or Inflation, Which Will the Fed Choose? by Michael Lebowitz from Real Investment Advice