Stimulus is Expensive

Column #384 January 6, 2023

I was born in 1944. My first awareness of a presidential campaign was in 1952. The election was held on November 4, 1952, and Republican Dwight D. Eisenhower won a landslide victory over Democrat Adlai Stevenson II. That ended a string of Democratic Party wins that stretched back to 1932. There were buttons galore and speeches on TV back then and it was all very exciting even though I was clueless as to the big picture.

But in the years to follow, because of its persistently negative impact on me financially and in terms of quality of life, I learned to pay attention to politics. And the closer I looked, it never ceased to amaze me how much the politicians and bureaucrats are out of touch with the realities of life. The old parable of the blind men and an elephant seemingly fits whatever situation involves government. But worse than that, most politicians believe they are smarter then everyone else and bureaucrats are addicted to the considerable power they have over virtually every person and business in the country—unless the person or business owns a powerful politician.1 2

As the years rolled by another vision came frequently to mind. It was about lemmings running in masse off of cliffs to their deaths or into the sea and drowning. That mythical depiction of the rodent is a perfect representation of a mob where people follow the crowd and act as one without conscious reasoning. These people vote for impractical governments, crooked and ignorant politicians, and kowtow to the bureaucrats. Where they come from is beyond me.

The result has been many decades of really stupid, compounding decisions involving wars, money, the banking system, fiscal integrity, regulations on businesses, tax structure, healthcare, welfare, border policies, education, the very structure of our governments, and much more. Once you start examining each disaster it’s hard to single out which of the many government-created fiascos is the worst. But there certainly are some stellar stand outs.

● Foreign policy blunders include: Iran in the 1970s, the Viet Nam war, Bush’s wars, and continuos interventions in the affairs of other nations including Ukraine. The result has been 70 years of warfare.

● The healthcare response to COVID was one of the most egregious and destructive events in the history of man.

● Regulatory straightjackets, created by the burgeoning bureaucracy with the help of huge businesses that control the politicians, continue to smother small businesses.

● The creation of a welfare system caused more poverty and a dependent class of citizens.

● Government sponsored and promoted outsourcing of trade with countries with lower labor costs gutted many industries in the U.S.

● The Federal Reserve Bank (Fed) was created in 1914.

● Gold was confiscated from American citizens in 1933.

● Commencing with WWII, our government has been running nonstop deficits which it refuses to address.

● Nixon slammed the gold window shut in 1973.

● Following more than 100 years of a stable currency under the gold standard, without the restraints of gold backing and balanced budgets, since 1932 the “official” purchasing power of the dollar has declined 97%.

Those few examples of insanity may even be eclipsed by more recent events proving that our gaggle of bureaucrats and politicians haven’t learned a thing from their past mistakes.

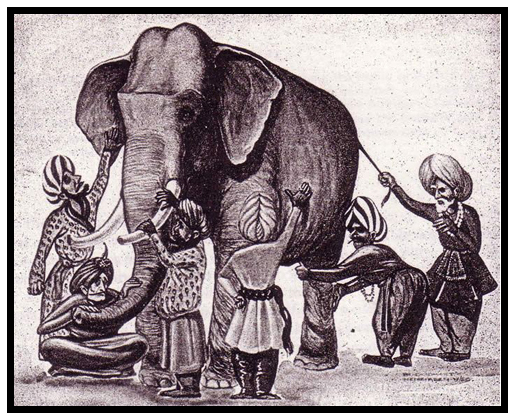

Everyone knows that today’s price inflation was caused by the excessive printing of money. Money printing as a policy has been going on for 90 years. But when the lockdowns started M2 growth exploded like never before.

The Fed printed the money on order to buy government bonds, mortgages, and other debts to stimulate the economy. Buy purchasing debt instruments the Fed lowered interest rates and pushed trillions of dollars into the economy. During the past few years the Fed was so aggressive in its approach that interest rates fell to essentially zero. On March 27, 2020, one-month Treasury Bills were yielding 0.01%. That’s a return of $1.00 per year on a $10,000 Treasury Bill. Thirty-year Treasury Bonds were yielding 1.29% which is $129.00 on a $10,000 bond. It wasn’t until March of 2022 that rates started to increase.3 4

Many ignorant people applauded the low interest rates and their government which handed out money willy nilly like a drunken sailor. I say “ignorant” because what the government and the Fed did was unconscionable. What’s really a big problem is that nearly every country on the planet has done the same thing. So the problem is a worldwide problem.5

Money printing and low interest rates impact all decisions regarding purchases, investments, and business strategies. Because money printing and low interest rates are unsustainable over time, nearly 100% of the financial decisions made by everyone during the stimulosus era ends up being wrong. The reason being is that eventually interest rates increase. When that happens, the higher interest rates expose the decisions made based on low interest rates as reckless and irresponsible.

Today, one-month Treasury Bills are yielding 4.30%. That’s a return of $430.00 per year on a $10,000 Treasury Bill. Thirty-year Treasury Bonds were yielding 3.78% which is $378.00 on a $10,000 bond. These rates have not topped out yet because they are significantly lower than the price inflation rates in the economy. So the decisions made to borrow, spend, and invest made on the lower interest rates are just starting to get pressured. Take note that it has been just a couple of months that short-term rates increased above long-term rates and the M2 money supply started shrinking. In terms of economic policy, this is like slamming on the brakes. But in terms of time required to have an impact, it’s just the beginning!6

Today’s business environment is fighting the headwinds of higher costs all across the board. The cost of equity capital increased because the stock market is lower. The cost of borrowed money has gone up because bond prices have fallen and interest rates have increased. The costs for labor and services are increasing. The costs for raw materials (energy, agriculture, metals, lumber) are all higher than just a few years ago. The costs of finished goods are increasing at around 8% per year. And the government in its wisdom is increasing taxes on corporations and all citizens—in spite of the promises of “no new taxes.”

With business costs on the rise and consumers’ incomes lagging price inflation rates, profit margins are being squeezed. It’s in conditions such as these where surprises are on the downside. Businesses and individuals who thought they had plenty of cash on hand during the boom are discovering it’s not sufficient for handling the needs of a higher cost environment with slower inventory turnover. Just replacing inventories at a higher cost drains cash from the till. At some point, tight money forces businesses into liquidating inventories and laying off workers. That’s when the leverage of easy money starts working in reverse and a recession sets in. Since saving for a rainy day has been discouraged by government stimulus and the Fed’s low interest rates, a recession can turn into a major depression is a flash.7

Our government is still spending recklessly. Much of its new spending is totally wasteful in that it’s for a proxy war and pork barrel projects that will not lower costs or make businesses more efficient. By spending more the government is actually growing bigger which increases the financial burden on businesses and the citizens. Therefore the government is relying on the Fed to fight price inflation with its tools alone—which means higher interest rates and contracting the M2 Money supply.

The money stimulus that started with the 2008 recession has resulted in an everything bubble. Then in just the past 34 months the U.S. government went crazy and spent more than $8 trillion. The everything bubble that spending created is now bursting. The consequences of decades of deficit spending and the more recent explosion of spending will have consequences. Always in the past there have been boom bust cycles. To expect our modern, seemingly perpetual boom to not have a reactionary bust is delusional thinking at its best.

In the months directly ahead cash will be king. The entire reason the Everything Bubble burst was because the Fed maintained its emergency level monetary policies for far too long. The recession of 2020 supposedly ended in May of that year, but the Fed printed $2.6 TRILLION after that, while also keeping interest rates at zero. The end result was 8% price inflation. Until inflation is tamed the Fed can’t even try to cushion the impact of its tighter monetary policies. If it did, price inflation would quickly get much worse.

The real danger in attempting to slow the economy lies in a possible debt implosion. That’s when every bankruptcy leads to another debt failure and the credit system tumbles like a row of falling dominos. It has happened in the past following rapid credit expansions. Therefore, one can’t fully discount the probability of it ever happening gain.8

Now is the time to build one’s liquidity ahead of the crowd. In a debt contraction the dollar will be king—which is the exact opposite of what everyone is expecting. And the one bit of good news is that, for the first time in 15 years, dollars in a short-term bank savings account earn a halfway decent interest rate.

To your health.

Ted Slanker

Ted Slanker has been reporting on the fundamentals of nutritional research in publications, television and radio appearances, and at conferences since 1999. He condenses complex studies into the basics required for health and well-being. His eBook, The Real Diet of Man, is available online.

For additional reading:

1. Blind Men and an Elephant from Wikipedia

2. It Takes a Village of Bureaucrats to Implement Despotism by Barry Brownstein from Truth Under Cover

3. Daily Treasury Par Yield Curve Rates from U.S. Department of Treasury

4. Slow Pace of Balance Sheet Reduction Calls Into Question Fed’s Commitment to Inflation Fight from Schiff Gold

5. Spain Is Latest To Announce Billions In "Inflation-Relief" Stimmies

6. Money-Supply Growth Turns Negative for First Time in 28 Years by Ryan McMaken from Mises Institute

7. 2023: You Wanted Endless Stimulus, You Got Stagflation by Daniel Lacalle from Thinking Heads