The Modern-Day Pet Rock

Column #326 December 3, 2021

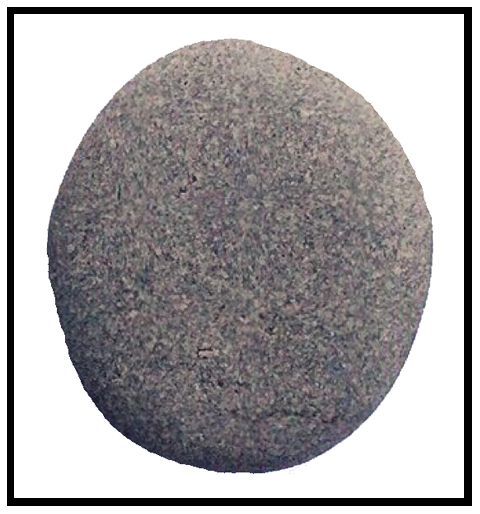

Do you remember 1975's Pet Rock fad? Lots of people bought them and the “inventor” became an overnight millionaire. The pet rock fad didn’t have the staying power of other collectibles so it only lasted one year.1

Baseball cards, Barbie dolls, Tonka trucks, artwork, model trains, antique cars, coins, stamps, and other memorabilia generally have been popular with collectors for generations. It follows because people like to collect items which remind them of their past. Even so, values rise and fall with the times as new generations come and go and the cycles boom and bust.2

Investments such as stocks, bonds, precious metals, diamonds, CDs, commodities, real estate, and cryptocurrencies also have their cycles. Primarily their cycles are driven by the expansion and contraction of credit and the emotional state of investors. Investors can literally go gaga and bid up prices to wild extremes that have no earthly connection to underlying value. The other extreme occurs when they’re gripped by fear and they sell out at the bottom at ridiculously depressed values. Roller coaster emotions aren’t limited to just stocks and collectibles. Back in 2006 the real estate boom peaked and was followed by a classic bust. In the ranching business some years back people paid outrageous prices for llamas, ostriches, and alpacas. Their enthusiasm lasted quite a few years before sanity set in and prices dropped to realistic levels.

During the past 18 months the stock market has been on a rip with prices soaring to the “highest valuations of all time.” Even companies without any sales and earnings are at very lofty levels. The S&P 500 index is selling at 3.1 times “sales” which is more than twice what is considered as normal. (Think about that!) And maybe the wildest “investment” category out there has been the cryptocurrencies. (More on crypto below.) And what is it that has powered investor enthusiasm for not only stocks but real estate, precious metals, collectibles, and cryptocurrencies?3

You guessed it. It’s easy money and greed. I’ve seen it many times in the past and it’s always a round trip exercise. When the Federal Reserve (Fed) pumps out the cash, it’s like serving spiked punch at a college fraternity party. As the night wears on the party gets more boisterous and eventually everyone goes nuts and runs off the rails. Never before in our country’s history has a “party” been served so much Fed-sponsored stimulus (spiked punch). There will be a hangover.

After stocks, real estate, collectibles, precious metals, and similar investments crash and burn people hate them. Even savvy investors become extra cautious. But when prices are soaring and the rewards become addictive, all investors become more confident. Even at the top the skeptics are afraid to sell for fear of missing out (FOMO). That’s when confidence peaks and we might have already seen peak confidence in this everything bubble.4

Many decades ago my friend John Exter used to say that “Confidence is suspicion asleep.” The first time I heard him speak was at a mining conference in 1970 at the Sheraton Hotel in Portland, Oregon. It was my good fortune to meet him in the men’s room (of all places) where I was able to ask him some questions. That was a game changing moment for me. At that time John was a highly respected Senior Vice President with First National City Bank (Citibank) and he was responsible for foreign relations with central banks and governments. I was a 25-year-old gold nut who wanted to learn more.5

I became one of his “clients” and for the next twenty plus years we met frequently—once it was in his home on the east coast. I consider him to be one the more formative people in my life. At the 1970 conference he explained how the savings and loan industry was going to collapse because it had been borrowing short and lending long. By 1980 one-third of the S&L industry was gone and the remaining shells were folded into commercial banks. That was just one of his many macro economic predictions to come true.

Exter also predicted the failure of all fiat currencies and famously labeled the International Monetary Fund’s new, highly admired Special Drawing Rights (SDRs) as a “who-owes-who-nothing-when” monetary instrument. (SDRs are still being pumped out like toilet paper.) He called all currencies “IOU Nothings.” In both cases he was right. Even though the dollar has been one of the world’s stronger currencies and is still around, since 1970 it has lost more than 86% of it’s purchasing power. I can only imagine how much scorn he would heap on the cryptocurrency mania that has gripped today’s world.6 7

So, is crypto the new money? Or is it the woke generation’s pet rock?

Money has to be acceptable, recognizable, divisible, homogeneous, durable, portable, a store of value, a measure of value, and have great value. Before money came into use as we know it, barter was the method of exchange. For instance one cow was worth ten nanny goats. Certainly many near-money substances also worked as money in limited instances. Eventually, beginning about 7,000 years ago, gold and other metals came into use. About 3,000 years ago gold coins became the most universally accepted money with silver coins a close second. Base metals also played a roll from time to time.

Looking back over the past 7,000 years we can see that gold’s value, relative to commodities, goods, and services, remained quite stable. Gold performed the role of money for thousands of years as all goods, services, and commodities, priced in gold, varied up and down independently relative to each other and also with the credit cycles. This long history of consistently maintaining relative value in the best and worst of times underscored gold’s “store of value” and “measure of value” attributes.

Then along came currencies (paper money). Paper money is merely a contract to deliver money, or anything of value, on demand. It is not money. Only if a currency is believed to be redeemable for money does it become acceptable in the marketplace. Originally, America’s currency was redeemable for a certain weight of gold or silver, then later it was only gold, then after 1932 only silver, and then in 1971 it became an IOU Nothing. But people continue to believe the IOU Nothing has intrinsic value even though it has lost more than 95% of the purchasing power it had in 1932.

Our nation’s fiat currency is simply a Federal Reserve Note that’s backed by U.S. Treasury Bills (and various other debt instruments such as mortgages) that are then payable in Federal Reserve Notes. The currency itself is not durable nor a store of value or measure of value over the long-term. Its acceptability is 100% based on public confidence and, as mentioned before, confidence is suspicion asleep.

Currently the paper dollar’s primary value is for trade and for paying off dollar-denominated debts. It’s important to understand the debt part. That’s because when the banking system makes a loan or the Fed buys financial assets, dollars are printed. Since a society can only handle so much debt before it can no longer service it, at some point the credit bubble stops growing and then it contracts. This is a real problem when the dollar is a debt instrument payable in nothing, because a debt implosion can result in a total wipe out of the entire credit structure.

Now that we understand the difference between money, currencies, fiat currencies, and debt, how do we classify the so-called cryptocurrencies? For starters, they are not universally acceptable. They are not even recognizable by most of the world’s population. I wouldn’t know one if I saw one. They are not portable in the same sense as a coin in your pocket. They are not time tested for being stores of value nor are they good measures of value. In just the past two years, relative to most services, goods, and commodities, the popular Bitcoin increased seven fold. That’s certainly not stable in value.

So, how is Bitcoin connected to the real world of services, goods, and commodities? A precious metal coin is something tangible. It’s real, can’t be counterfeited, nor created out of thin air. A digital currency such as Bitcoin is the same as a dollar “deposited” in a bank’s computer system which can be here today and gone tomorrow. No person, institution, or government stands behind any of the cryptocurrencies to provide services, goods, commodities, or real money on demand. A cryptocurrency is just like—a pet rock.

Because the entire world has ballooned their debt structures to unprecedented levels, all countries are headed for a credit contraction. When the contraction starts it’s not something that can be controlled. It begins slowly as some debts are paid off by a few worried debtors. As their debts are retired the currency supply shrinks and business conditions slow down.

Keep in mind, much of today’s demand is due to people/businesses/nations borrowing and spending newly created paper money. So when the debts stop growing, there is less paper money to spend therefore business conditions will contract. This causes a scramble for more dollars to service debts.

After the contraction starts, worried lenders will call in the riskier collateralized loans, forcing assets to be sold for dollars to pay off dollar-denominated debts. As more debts are retired the currency supply shrinks even more and a depression starts and more debts are called. Then a point comes when unserviceable debts are bankrupted out of existence. Keep in mind that margin debt collateralized by stock holdings is at a record high. When margin calls go out, stocks are sold immediately at whatever price they’ll bring. That creates a cascading waterfall event.8

The most important thing to understand is that as the debt structure shrinks so does the supply of currency required to service the debts. This snowball effect reverses the impact that expanding debts had on stimulating consumption.

In a credit contracting environment you can bet your bottom dollar that the stock market will crash. Real estate will take a big hit. Every collateralized asset, and some assets that aren’t used as collateral, will be for sale to meet margin calls. For certain, cryptocurrencies will get smashed. And, even the bloated gold market will be hit.

But unlike irredeemable currencies, gold is money with a 7,000-year track record. At some point during the contraction it will find a floor as credit instruments continue to fail. That point may be around $500 to $600 an ounce, an adjusted price similar to 1932 and 2000. The reason it will have a floor is because gold can’t default. On the other hand, Bitcoin can fall to zero because it has no tangible value, is not redeemable for anything, and its value is based solely on confidence. Once again, crypto is like a pet rock.

Here are a few cryptocurrency facts that are floating around. Buyers seem to have a religious attitude toward cryptocurrencies. There are about 14,000 different cryptocurrencies trading on more than 430 venues. Combined, their market capitalization is about $2.5 trillion dollars. All of them exhibit high volatility, produce no income, and none are redeemable. Maybe 90% of the trading volume is speculation, 7% is money laundering, and less than 3% is for commercial transactions.9

Interestingly, two industries I follow are pleasure boating and private aircraft. Both industries are gloating over the fact that sales haven’t been this good since 2007. Neither industry equates that to a cyclical top in the credit cycle. I guess the assumption is that these good times are just warming up and people will just keep on borrowing and spending. This is the same thinking behind all assets today—especially cryptocurrencies.

In closing, I want to at least mention John Exter’s famous upside down credit pyramid. But I’ll save the full explanation of it for a future letter. For now, avoiding plunging prices in all of the many trading assets that were pushed higher by the “everything bubble” is of paramount importance. Be safe by taking advantage of any market euphoria.

To your health.

Ted Slanker

Ted Slanker has been reporting on the fundamentals of nutritional research in publications, television and radio appearances, and at conferences since 1999. He condenses complex studies into the basics required for health and well-being. His eBook, The Real Diet of Man, is available online.

Don't miss these links for additional reading:

1. The History Of The Notorious Pet Rock (And The Inventor Who Became A Millionaire) from Groovy History

2. Contemplating Collectible Investments by Andrew Beattie from Investopedia

3. S&P 500 Price to Sales Ratio from Multpl

4. Is A Stock Market Crash Like 2000 Possible? by Michael Lebowitz from Real Investment Advice

5. John Exter from Wikipedia

6. Special Drawing Rights from Wikipedia

7. The IMF, Special Drawing Rights, And Expanding The Burden Of Government by Daniel J. Mitchell from Townhall Finance

8. Security Brokers and Dealers; Margin Accounts at Brokers and Dealers; Asset, Level from Federal Reserve Bank of St. Louis

9. How Many Cryptocurrencies Are There? By Connor Sephton from Currency Com