Bear With Us

Column #420 September 15, 2023

Don’t be fooled by the stock market’s ten-month rebound that actually motivated some analysts to predict we’re in a new bull market. In the big picture, that rebound was merely a dead cat bounce before what I expect to be a truly impressive collapse in stock market valuations. The reason being is that stocks are already richly valued with the S&P price to earnings ratio at 25.72. In bad times that ratio can drop into single digits on even lower earnings and that means these are high risk times.1

In terms of business conditions the world is struggling. The earnings of nearly all businesses, large and small, are being negatively impacted by the rising costs for loans, inventories, energy, services, and wages. Even the Federal Reserve Bank (Fed) is losing money. For both businesses and consumers, debts that were cheap to service a year ago are becoming unaffordable. The Fed’s goal to restrict price inflation by elevating short-term interest rates above long-term rates is aggravating that situation because it’s causing a classic credit squeeze. These monetary steps have usually resulted in recessions in the past.2

Financial science (economics) is like the social sciences; it seems to make sense of the ongoing events, but it's not actual science like physics or chemistry. In spite of that there are certain absolutes which we can hang our hats on. One of them is that business conditions cycle. Bankruptcy is a normal part of capitalism and can lead to the cleansing of inefficient companies. It’s said that 44% of all companies that suffer a 70+% collapse—never recover. That makes riding out super cycle bear markets not very practical.

Economic cycles come and go and vary in severity. Wars and natural disasters can cause them. Hyperinflationary monetary conditions can cause them. But most are caused by excessive debt as governments, businesses, and consumers spend their incomes and take on debt to buy more of whatever. Eventually incomes can no longer support the cost of the accumulated debts and business conditions implode in a panic. That unwinds the debt structure and consumption drops precipitously. The multi-year crash following the business cycle peak in 1929 was the last major super cycle credit contraction in the United States. Since then there have been many recessions and credit crunches that were less severe, but the associated collapses in stock market valuations during the pauses in credit growth were still quite painful. That's the nature of capitalism.

The major market indexes (DJIA, S&P 500, Wilshire, and NYSE Composite) peaked in January 2022—a full 20 months ago. The NASDAQ and Russell 2000 indexes peaked in November 2021. Those peaks capped 90 years of generally increasing stock prices following the Great Depression lows set on July 8, 1932. That 90-year period saw debts grow almost nonstop while the dollar lost more than 96% of its purchasing power.3 4

In the spring and summer of 2021, prior to the recent peak for most stock prices, the prices of meme stocks imploded after experiencing meteoric increases earlier in the year. They literally turned into trash months before the market’s ultimate top. In terms of the big picture it was after the major market indexes peaked that the actual first downleg in the new super cycle bear market got underway.

The first downleg bottomed in October 2022 amid a lot of hand wringing. Yet the reflexive rebound was so enthusiastic that it actually reignited bullish sentiment to the point where meme stocks started going crazy once again. Even cannabis stocks exploded higher in the past couple of weeks. Calls for the rebound ushering in a new bull market were in the news, yet the big picture has a different message.5

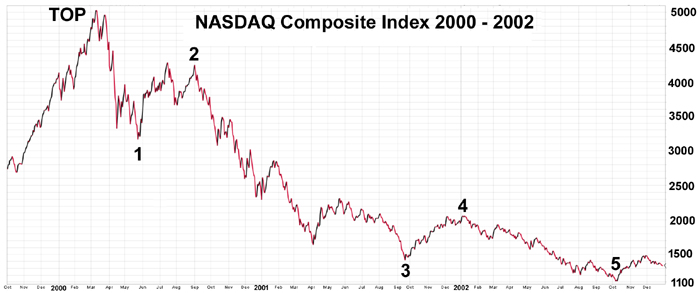

For an idea of what the big picture of a bear market looks like, let’s examine the NASDAQ chart from 2000 to 2002. It’s a good example because that tech stock market crash followed a typical bear market pattern.

Following the “top” the first downleg is labeled as number “1." In the NASDAQ example that initial 37% plunge was followed by an enthusiastic rebound labeled “2” where stocks jumped 35%. Then along came the devastating leg “3." It subdivided into five legs over the course of a year with stock prices plunging 67%. That was followed by the leg “4" rebound of 45%. The final leg “5” lasted ten months and plunged 46% to establish the ultimate bottom. That NASDAQ bear market lasted 30 months and, overall, the Index fell 78%.

Markets are emotion based and consequently they follow rhythmic patterns. The patterns are representative roadmaps and not exact roadmaps. Therefore every bear market cycle differs from the other in time and range. This is why market analysts can only point to comparisons in the NASDAQ crash that started in 2000 with the stock market crash that started in 1929. When plotted on a chart they aren’t exactly the same, but they have a similar look. In 1929 there was the initial 50% crash followed by a 60% rebound that turned everyone bullish. Then the third leg kicked in and stocks were literally destroyed over the following two years. Because of this typical down-up-down pattern at the beginning of a bear market, some bearish analysts are projecting the current bear market to unfold in a similar fashion.

As previously stated, today’s market cycle peaked in January 2022. The first leg down bottomed in October 2022 and the market rallied in leg two to peak in August 2023—last month. That’s the beginning of the typical down-up-down pattern. There’s the bull market peak, the first downleg followed by a enthusiastic second leg rebound, which is followed by a devastating third leg to the downside. Then the fourth leg rebound with fifth leg down to mark the end of the bear market.

Based on this typical pattern, today’s market is poised at the beginning of the devastating third leg to the downside. It could knock the DJIA index down 60% from 34600 to 13840—about the level the DJIA was in 2007. That could be followed by a nice rally over some number of months before leg five takes the index down to 7000. As measured by the DJIA, during the next year or two the bear market from top to bottom could erase 81% of total stock market valuations.

Yes, that all sounds a little crazy for sure. But if you factor in a partial unwinding of the credit structure, accompanying bank closures, the bankruptcies of overextended businesses, and more conservative valuations for stocks generally it’s certainly not impossible. That’s why being liquid and holding dollars instead of assets is a good idea at this time. Seasonally, stock markets are famous for falling in September and bottoming in October. So the next five weeks are an especially dangerous time. After the October low there could be a bounce into December followed by a lower low in May—a month also known for setting market lows.

A super cycle bear market may take a total of several years to unfold. In the past the rallies that punctuate them still offer exciting upside action. But participating in the rebounds calls for being a nimble investor who pays attention to where he is in terms of the cycles. The main point going forward today is to avoid being caught in the devastating leg three and later on the shorter wave five.

As we all know, projections of stock market activity is a tricky business. There are no guarantees. There are no absolutes. Even how the Fed will react going forward is no longer as predictable as in the past 90 years. Will the Fed continue to fight inflationary pressures and defend the dollar? Or will it join the crooked politicians and inflate our currency away like Tucker Carlson explains has happened in Argentina.6 7

Consequently, in terms of prices there are the prices we see and what they are when adjusted for currency debasement. For instance, from a February 1966 high of 995 to the ultimate low of 759.13 in April 1980 the DJIA had declined 23.7%. But when adjusted for currency debasement the DJIA 1980 low was actually 300. That means an investment in the DJIA lost 69.8% of its purchasing power over 14 years.

Investing in cash or being short the markets may not seem to be practical in this day and age of inflation. Per normal, just like in the past, most folks think that way near market peaks which means they aren’t expecting the third leg. Obviously, for those who are more aware of history this is a time to prepare for the worst and hope for the best.

To your health.

Ted Slanker

Ted Slanker has been reporting on the fundamentals of nutritional research in publications, television and radio appearances, and at conferences since 1999. He condenses complex studies into the basics required for health and well-being. His eBook, The Real Diet of Man, is available online.

For additional reading:

2. Lots of Red Ink at the Fed by Alex J. Pollock from Mises Institute

3. Timeline of U.S. Stock Market Crashes by Ward Williams from Investopedia

4. Consumer Price Index Data from 1913 to 2023 from US Inflation Calculator

5. What Are Meme Stocks, and Are They Real Investments? by Adam Hayes from Investopedia

6. Tucker Travels to Buenos Aires for a Glimpse of What Our Future May Hold

7. Tucker Discusses Hyperinflation with Argentina's Libertarian Economist Javier Milei and the precarious economic situation which has made Argentina's citizens desperate for change.