Grand Supercycle Bear Market

Column #364 August 26, 2022

Cycles are a natural occurrence in nature, human activity, the solar system, and about everything else. Many cycles impact us directly with some having a significant impact, others less so, and some not at all. During the past year I’ve been harping about the money and credit cycle and it’s a cycle that will impact every living person no matter their status. If it catches you by surprise, it could be disastrous.

A cycle can be a very long-term event that’s made up of hundreds of smaller cycles of varying degree. The stock market provides many examples. There’s the big 1932 to 2021 Supercycle which consisted of numerous cycles with notable tops in 1938, 1966, 1987, 2000, 2007, 2016, 2018, and 2020. Elliott Wave principles indicate that that combination of bull market cycles represented a completed Supercycle. It will be followed by a new corrective bear market cycle that will erase a huge percentage of the gains of those previous 90 years. It will be similar to the “correction” that commenced in 1929 and ended in 1932 which also concluded a major bull market that had gone on for decades.

YES—extreme bear markets can happen again. They haven’t been outlawed. Don’t think for a minute that extreme distortions in the market in one direction won’t be corrected by extreme distortions in the opposite direction. It’s the way markets have cycled for all of time. Just look at the “minor swings” of the past 50 years involving stocks, real estate, gold, bonds, and recently cryptocurrencies. Some have been whoppers and they were wicked corrections in the same long-term super bull market.

Robert Prechter (RP) is known as the world’s foremost Elliott Wave Theorist. His studies of people and their reactions to events are legendary and he has used the Elliott Wave approach in mapping their “feelings” which generate various patterns when plotted on a chart. That happens because market cycles for stocks, bonds, commodities, real estate, cryptocurrencies, and gold are caused by people buying and selling together like a flock of sheep. Interestingly, when prices are plotted versus time, distinctive patterns develop which to the trained eye are like road maps.1

RP has defined the market’s differing cycles as:

● Intermediate

● Primary

● Cycle

● Supercycle

● Grand Supercycle

A lot of RP’s work is based on the Fibonacci Sequence and wave patterns. The Fibonacci Sequence is not a cycle, but more of a pattern for wave action. The sequence is 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, and so on forever. Add 0 + 1 and you get 1. Add 1 + 1 and you get 2. Add 1 + 2 and you get 3. Add 2 + 3 and you get 5, etc., etc. Each leg up approaches 1.618034 times the previous number in the sequence and that number is called the “Golden Ratio.”2 3

Elliott Wave also focuses on wave patterns. They can be impulse moves, zig zags, ABC moves, three wave, five wave, trends, etc. These wave patterns are largely predictable because they are caused by relatively consistent human reactions to price fluctuations therefore they are not random. Interestingly, corrective moves within waves tend to find resistance at these Fibonacci point percentages: 0.236, 0.382, 0.618, 0.786. For instance a stock moves up $10 and then drops back $6.18 where it finds support for the next move up.4

RP has charted market cycles back to the birth of the country in 1788 when the Constitution was ratified. To help explain where we are in the big picture, he has provided SGFM readers with two links. The first is a full copy of his “Elliott Wave Theorist” dated January 13, 2022. The second link is to his “Top for the Ages” presentation.5 6

I strongly urge every reader to read the links. From the many charts you can easily see just how skewed (woke) the world’s markets got as the “bull market in everything” charged higher and higher. People went completely berserk. These people include leaders, academics, brokers, bankers, investors, and even people who never think about investing. The excesses became norms and the norms were eventually exceeded by even greater extremes. Just about everyone got caught up in the mania.

I’ve been investing in markets for more than 60 years. In that short time I’ve experienced many cycles that swung from people literally dancing in the streets to having to live in the streets because they lost everything. But none of the cycles that I lived through were as bad as the credit implosion that occurred between 1929 and 1932. Most Americans have no idea why it went down. But if you read the links then you’ll understand why the odds of another Grand Supercycle Bear Market are so high. For certain, this is a bear market that must be avoided.

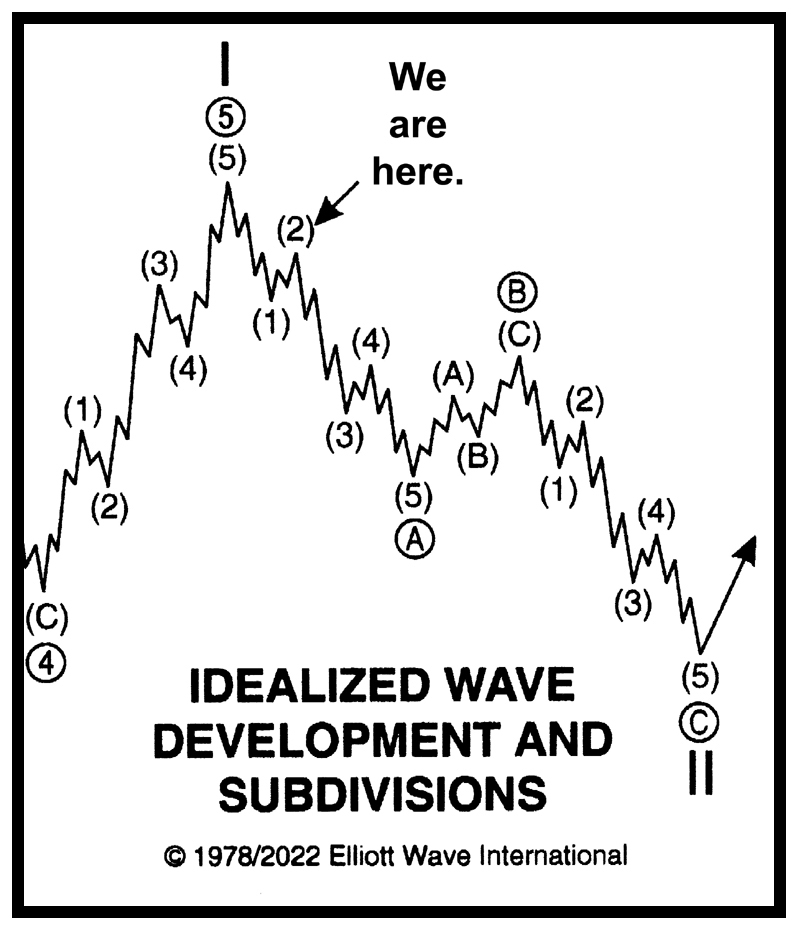

The Grand Supercycle Bear Market actually started in 2021, yet the final peak in most indexes occurred in January 2022. Wave (1) down (the first wave) bottomed on June 17, 2022, and it had everyone screaming because stock and bond prices had dropped 20%. Then a rebounding Wave (2) started which convinced everyone that the bear market was over. But Wave (2) looks like it topped out on August 16, 2022. That means it will be followed by a much larger Wave (3) down, then a small Leg (4) up, followed by a Leg (5) down.

The image for this column is an idealized Elliott Wave Form. It’s not based on time, but wave patterns. I drew in a “We Are Here” with an arrow pointing to the top of Wave (2). Wave (1) is over and it was just the beginning of The Grand Supercycle Bear Market. This bear market in everything will consist of numerous five wave declines that are spaced out between short rallies of various shapes and times. This won’t be pretty.

Our nation’s leaders will try to fight the cycle. But fighting the cycle will only make it worse. Government, corporate, and private debts are so excessive they are unsustainable at today’s low interest rates. Yet to contain inflation, rates will be increasing. Therefore debts will either be paid off or bankrupted out of existence in a snowball effect. The speculative excesses of the everything bubble will be addressed one way or the other.

At my request Elliott Wave posted two important pages on their website that I want you to see. Both are loaded with highly informative charts, many of which even a novice can figure out. Open them up. “The Elliott Wave Theorist” is quite technical at first glance. But instead of trying to figure it out all at once, just make sure to look at Figures 8, 9, and 10. They show the entire progression of the 1932 to 2021 bull market and their Fibonacci relationships. Figure 13 is really mind blowing because it shows how extreme today’s overvaluations are in terms of Book Values and Dividends. Those figures are easy to understand.

Then open up the “Top for the Ages.” It is loaded with comparisons of today’s extremes to the recent past. You can watch it or just switch to the text which also has the images. Keep in mind that overvaluation extremes are always answered by undervaluation extremes. Therefore this Robert Prechter talk, originally given at a conference, was designed to be easily understood. The indicators of extreme are unbelievable.

This is an excellent time to sell assets and hold cash and/or go short. Yes, inflation is everyone’s concern at the moment. But as prices start crashing again, the risk is in defaulting debts. As debts are forced to be paid off or as they default, the money supply will shrink and the Fed will be powerless to stop it.

Knowledge is power. So, don’t discount today’s risks.

To your health.

Ted Slanker

Ted Slanker has been reporting on the fundamentals of nutritional research in publications, television and radio appearances, and at conferences since 1999. He condenses complex studies into the basics required for health and well-being. His eBook, The Real Diet of Man, is available online.

Don't miss these links for additional reading:

1. Elliott Wave Theory: Rules, Guidelines and Basic Structures from Elliott Wave Forecast

2. What Is the Fibonacci Sequence? by Tia Ghose from Live Science

3. Fibonacci Sequence by Cory Mitchell from Investopedia

4. Master the Fibonacci Retracement: The Ultimate Guide Technical Analysis from Madame Investing

5. The Elliott Wave Theorist January 13, 2022 by Robert Prechter

6. Top for the Ages by Robert Prechter